PART 4 - PRACTICAL TIPS FOR PRACTISING PHYSICIANS

Part 4 - Practical tips for the practicing Physicians

- Amit Chakrabarty

- April 1, 2020

- 11:17 pm

My Dear Colleagues:.

These are tremulous financial times for the physicians esp those in private practice who, like me have mortgages pay and obligations to their loyal employees and their families.

I read a quote that was recently featured in a financial publication. Larry Fink, CEO of the world’s largest asset manager Blackrock, told his shareholders this:

“The world will get through this crisis. The economy will recover. And for those investors who keep their eyes not on the shaky ground at our feet, but on the horizon ahead, there are tremendous opportunities to be had in today’s markets.”

Thank you for your feedback and interest for my “practical tips” emails. I am sharing a couple of other such tips that I have confirmed. Hope this helps.

Trump Administration Provides Financial Relief for Medicare Providers

The Centers for Medicare & Medicaid Services (CMS) is announcing an expansion of its accelerated and advance payment program for Medicare participating health care providers and suppliers, to ensure they have the resources needed to combat the 2019 Novel Coronavirus (COVID-19). CMS anticipates that the payments will be issued within seven days of the provider’s request.

To qualify for accelerated or advance payments, the provider or supplier must:

- Have billed Medicare for claims within 180 days immediately prior to the date of signature on the provider’s/ supplier’s request form,

- Not be in bankruptcy,

- Not be under active medical review or program integrity investigation, and

- Not have any outstanding delinquent Medicare over payments.

You can call their helpline and they are very prompt and helpful. If you have any questions, please email me back.

Coronavirus Aid, Relief, Economic Security (CARES) Act

The legislation includes a waiver of required minimum distributions (RMDs) for 2020. This waiver applies to company savings plans and IRAs, including both traditional and Roth inherited IRAs. The rationale behind this waiver of RMDs is mainly due to protection of assets that may have declined due to COVID-19 crisis. An RMD waiver is a big help for those who would have had to take a 2020 RMD based on much higher account values that were set on December 31, 2019. Now they can sit out a year and avoid the tax bill on their 2020 RMDs. A similar piece of legislation was enacted in 2008 during the Great Recession. As a reminder, the SECURE Act that was passed in December 2019 moved the RMD age from 70 ½ to age 72 if you were not already taking required distributions.

It is worth noting that you CAN take an RMD if you so choose, but you are not forced to take one.

- Another provision of the CARES Act waives the 10% early distribution penalty on up to $100,000 of 2020 distributions from IRAs and plans for affected individuals. The tax would be due, but could be spread evenly over 3 years, and the funds could be repaid during the 3 years.

- 401(k) loan limits have been increased to the lesser of $100,000 or 100% of the account balance. The usual limit is the lesser of $50,000 or 50% of the account balance.

- The program provides $250 billion for an extended unemployment insurance program and expands eligibility and offers workers an additional $600 per week for four months, on top of what state programs pay.

- Another important thing to remember is that the 2019 tax filing deadline has been moved from April 15th to Wednesday, July 15th. As a result, you have until July 15th to make contributions to any IRA accounts. Same thing for Health Savings Accounts (HSAs).

Update on the CORONA VIRUS EMERGENCY LOANS

(Follow up on the Part 3 Practical tips email sent last week)

There are two types of loans that we can apply.

From what we are understanding if you qualify you have the option to apply directly with the SBA for the disaster loan and can get $10,000 advance within 3 days while you are then waiting on the additional loan. This assumes you meet the criteria for the disaster loan.

Then there is a Paycheck Prevention loan (an SBA 7a loan) that is being administered by the banks and is meant to help businesses to continue to keep their employees hired and businesses operational. You can qualify for 2.5 x your average monthly payroll for the a 12 month period before the loan for a max of $10M. These loan proceeds will first payback the disaster loan mentioned above. Then if you use the monies over an 8 week period after the loan is issued to pay your business expenses including salaries, rent, interest on mortgages, utilities, or interest on any debt obligations (that you already had before the covered period) then you may not have to pay it back, provided that you maintain your workforce during that time. If employees have been let go then you will have the opportunity to call them back. The intent is that if you had 5 employees before this event and you are able to maintain 5 employees with the loan monies, then it will be forgiven. If you don’t spend all of the monies within the 8 weeks or you don’t have as many employees or you reduced their salaries, then only a portion will be forgive.

The next steps are to

1) apply directly with SBA online if you think you qualify for the disaster loan (I have done it)

and/or

2) contact your local banker to get on the list for applying for the Paycheck Protection loan (My bank will start within the next couple of weeks).

This is my best understanding but we are all learning how to navigate new details daily.

CORONA SCAMS

Be aware of specific, coronavirus-targeted fraudulent hacks

New scams specific to the coronavirus pandemic are being introduced and attempted daily. App scams have shown up in both iOS and Android stores, promising accurate tracking of new cases of COVID-19. Once downloaded, however, the apps insert malware that infects users’ devices and tracks their personal information.

In another scam, hackers pose as political, government or international health organizations and send phishing emails to users offering helpful tips through a link or download. It should be known, though, that authorities like the World Health Organization do not email people, especially at work.

——————————

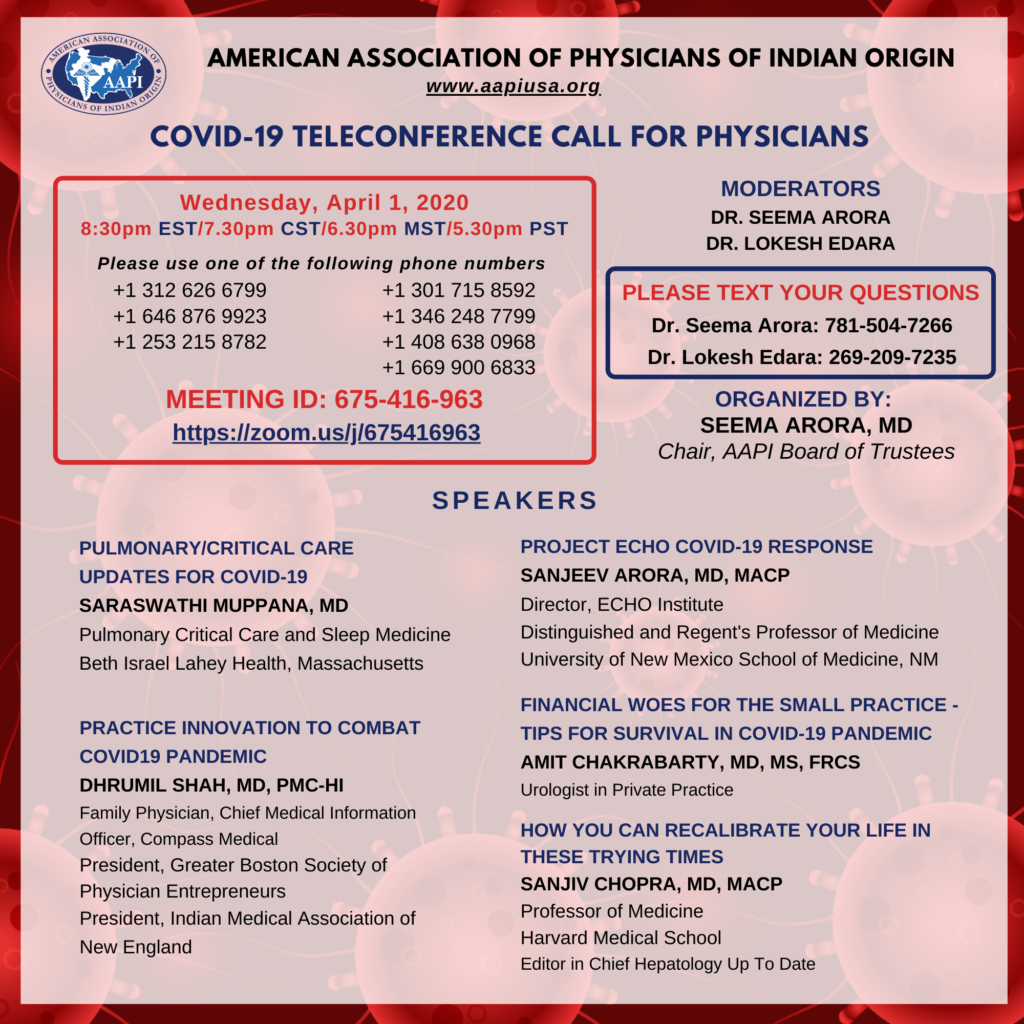

I will be a part of the AAPI teleconference on Wednesday 830 pm EST, where I will be speaking on : “Financial woes of the practicing physician – Tips for survival”. I will be answering any questions about my practical tips email – Part 3 and Part 4 . Please see details of attached flyer.

PS: I want you to know is email list that I have is what I have collected over years and certainly not all-inclusive. Please let me know if you want any of your friends to be included in the email list to get these updates. You can unsubscribe anytime.

Stay safe and stay healthy.

Amit Chakrabarty, M.D., M.S., F.R.C.S., F.I.C.S.

Amit Chakrabarty

Vice Chair AAPI Board of Trustees

President, Indian Medical Council of St. Louis 2018-2020

AAPI Board of Trustees 2017-2020

AAPI Patron Member since 2001

AAPI Governing body member for 10 years

AAPI Regional Director (2 years) 2004 to 2006